Build Your Business in a

$1.26B Industry

Offer Wills and Trusts through a modern platform designed to help you serve more clients and grow your practice.

The FastWill Pro Advantage

Designed for both families and financial professionals, FastWill helps you guide clients through estate planning with clarity and confidence, giving you the tools to deliver more holistic and meaningful planning experience.

Grow Your Practice

Unlock New Revenue Streams

Earn commission on every plan, or give them to clients for free as an added bonus.

Generate More Appointments

Estate planning complements financial, insurance, and investment services, making you a one-stop resource.

Bring More Value

Strengthen Client Relationships

Estate plans involve children, spouses, and heirs, giving advisors access to the next generation of clients.

Offer What Others Don't

Most advisors stick to investments or insurance, estate planning gives you a unique edge.

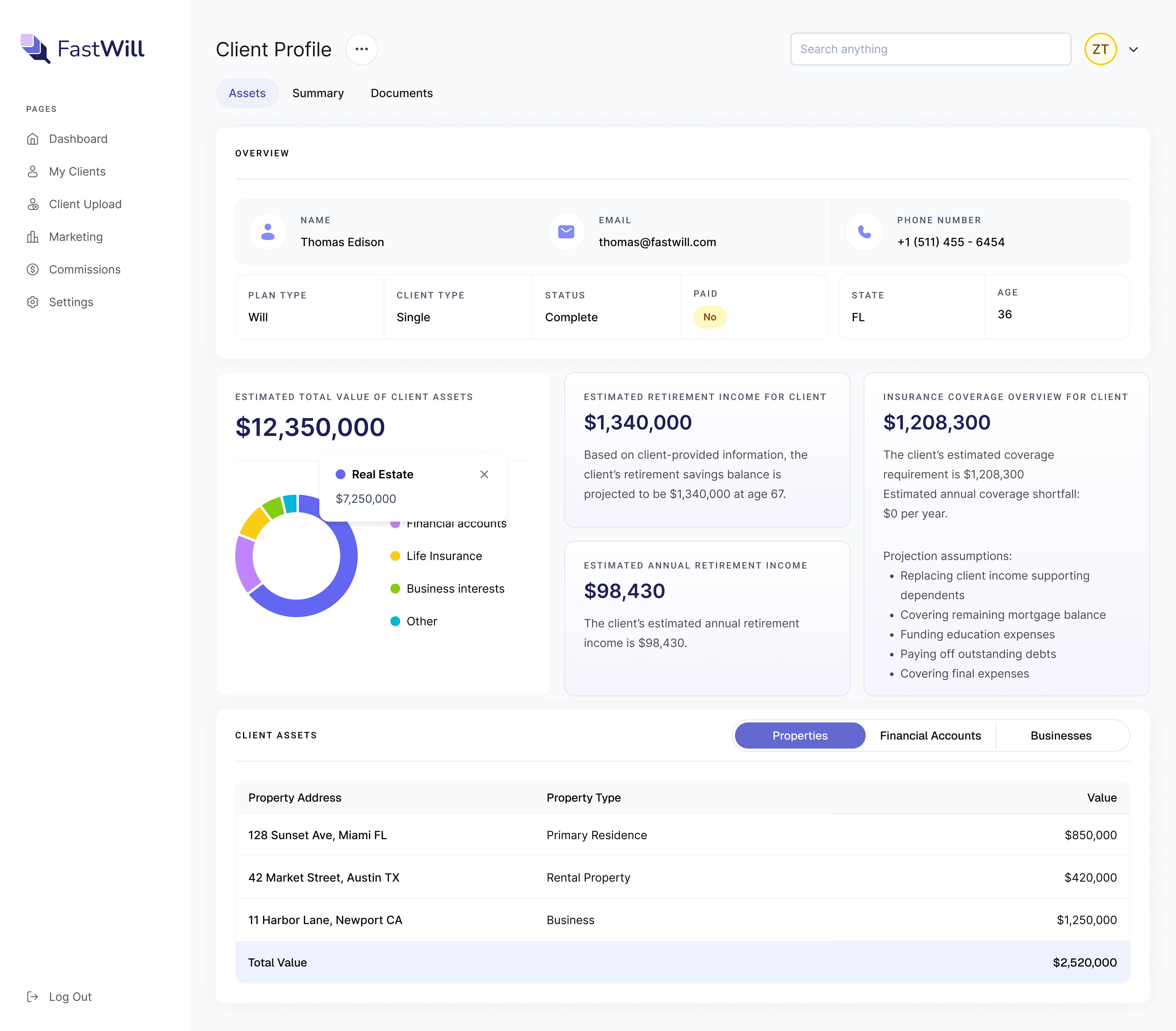

Gain Deeper Insights

Gain Access To Detailed Client Profiles

Get an overview of your clients assets, insurance, and financial goals to help you prepare for your meeting.

Implement Better Recommendations

Detailed profiles give deeper insight, helping you deliver tailored advice and stronger guidance.

Plans for Every Stage of Success

Whether you're exploring or expanding, choose the plan that matches your momentum.

Professional

Basic

Built for Pros, Not Just Individuals

FastWill powers estate planning for financial advisors, insurance agents, and professionals serving clients at scale.

How It Works

When you join FastWill, you get access to an estate planning platform that helps you book more appointments and expand your services.

Create your account to get started in minutes.

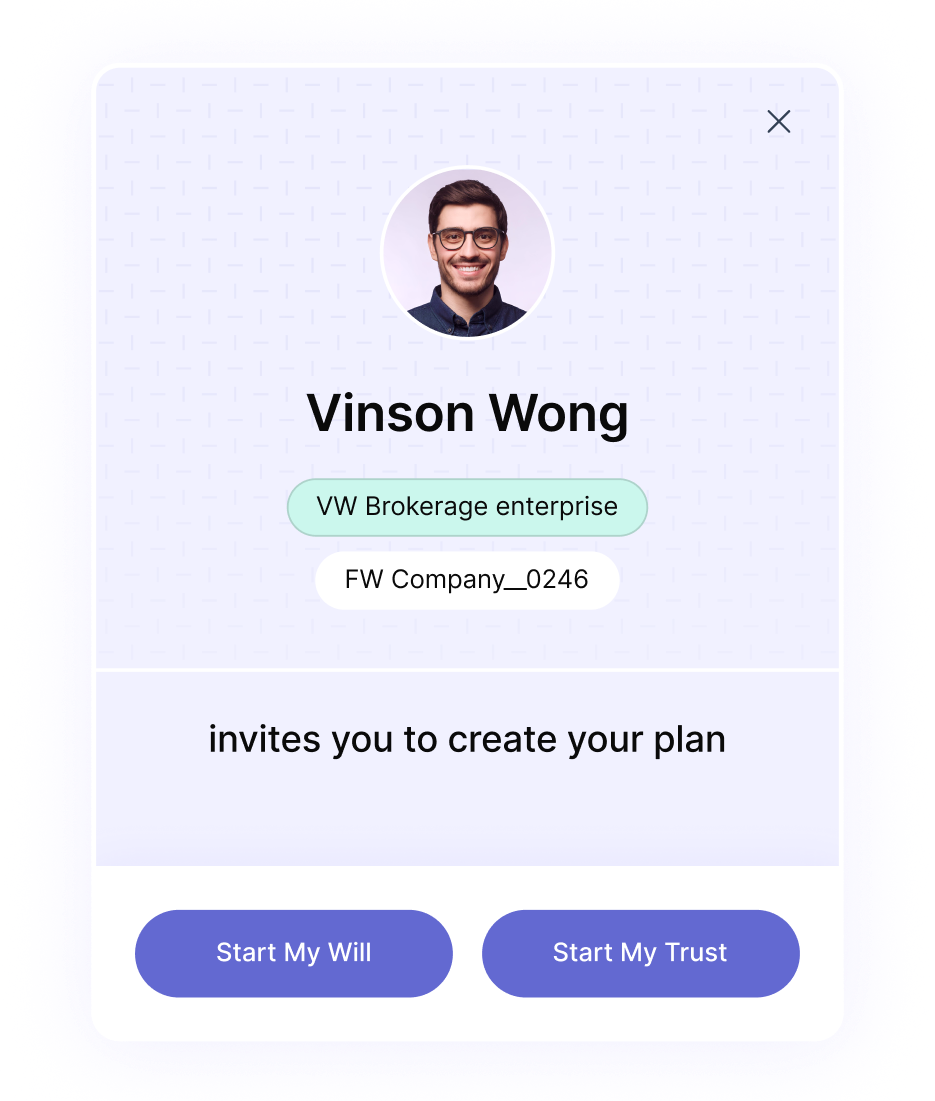

Share your custom invite with a client.

Your client completes their Will or Trust online.

Earn commission and view your new client profile.

Deliver a Fully Branded Client Experience

From the first referral link to the final calendar booking, FastWill makes it simple for clients to connect with you.

Start With a Referral Link

-

1Send a branded invite that looks professional

-

2Clients complete their plan online, no extra forms

-

3Seamlessly leads to calendar booking

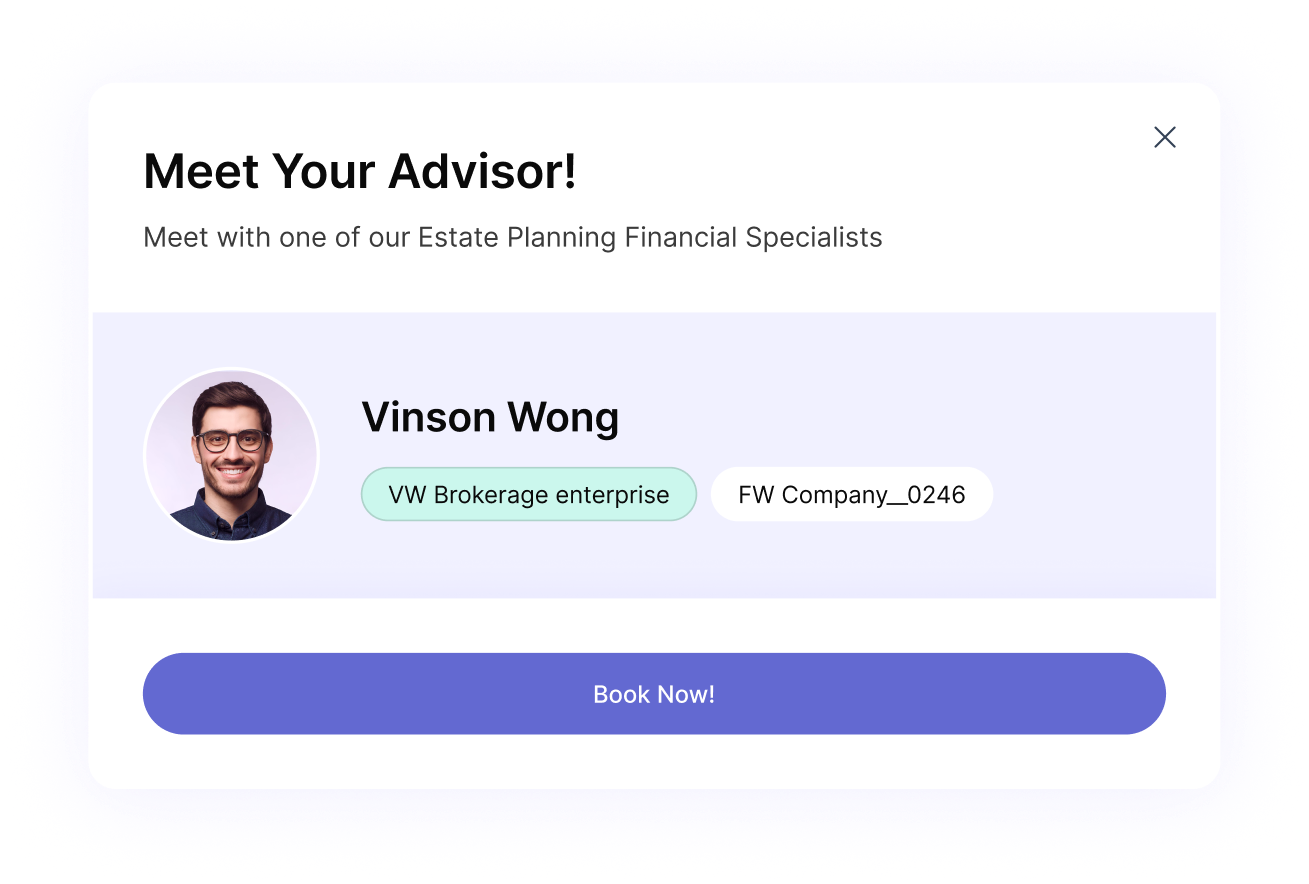

Finish With Direct Calendar Booking

-

1Clients schedule a meeting instantly after finishing their plan

-

2Appointments sync automatically with your existing calendar

-

3Fewer emails, faster conversations, stronger relationships

Gain Insights Into Your Client

FastWill builds a client profile automatically, so you can guide more meaningful conversations without extra paperwork. Turn every client profile into more revenue opportunities and stronger ROI.

Hear From Professionals.

Real testimonies from advisors and agents who continue to expand their practice with FastWill Pro.

Where Estate Planning Fits Into Your Client Relationships

From wealth transfer to new families, life events are fueling the growing need for Wills and Trusts. This is where our market meets yours.

Inheritances

An estimated $84 trillion will transfer between generations by 2045, creating massive demand for Wills and Trusts.

Business Owners & Sales

The U.S. has over 33 million small businesses, and many owners need succession planning and asset protection.

New Parents

About 3.6 million babies are born each year in the U.S., and families need Wills and guardianship plans.

Marriages & Divorces

Nearly 2 million marriages and 700,000 separations happen annually, both requiring updates to Wills and beneficiaries.

Home Purchases & New Movers

Nearly 30 million Americans relocate every year, and new homeownership often drives first-time estate planning.

Retirement & Aging

By 2030, 72 million Americans will be over age 65, driving demand for estate and financial planning.

Commonly Asked Questions

Still have questions?

Have questions or need assistance? Our team is here to help!

General

-

FastWill is ideal for clients with assets under $5 million who have relatively simple estate planning needs. These individuals seek to customize their estate plans according to their preferences without the expense and time commitment involved in working with a traditional attorney.

-

When clients purchase an estate plan, they receive one free month of access to our unlimited customizable subscription. After the first month, they can continue using the service for a small fee. All updates are managed online, and our team of experts is always available to provide assistance when needed.

-

Once you create an account and log in to your dashboard, you'll receive a personalized referral link that you can share directly with your client. As they begin the process, you can track their progress and request access to view their completed documents.

-

Typically, yes. Many leading firms and partners use FastWill, and most are open to providing additional options for their clients. If sending a link through your company email is a problem, you can share it directly via the FastWill platform. For any compliance concerns, we recommend consulting with your team.

-

Of course! Our support team is on hand to help your clients with any inquiries. They can be reached through email at support@fastwill.com.

Built for How You Work

A secure, state-specific estate planning solution designed for professionals.